Advanced Data Analysis Helps Connect the Dots to Highlight the Nation’s Top Performing Community Banks

In partnership with our parent company, OTC Markets Group, Qaravan assists stakeholders across the banking sector in simplifying, customizing and, automating the task of analyzing information from Reports of Condition and Income (Call Reports) and Uniform Bank Performance Reports (UBPR). Since bringing our performance analytics platform online in 2015, we’ve seen firsthand how having access to interactive versions of FDIC reports and regulatory data assists bank executives, regulators, and analysts in strategic decision-making and instills a greater confidence among the investment community.

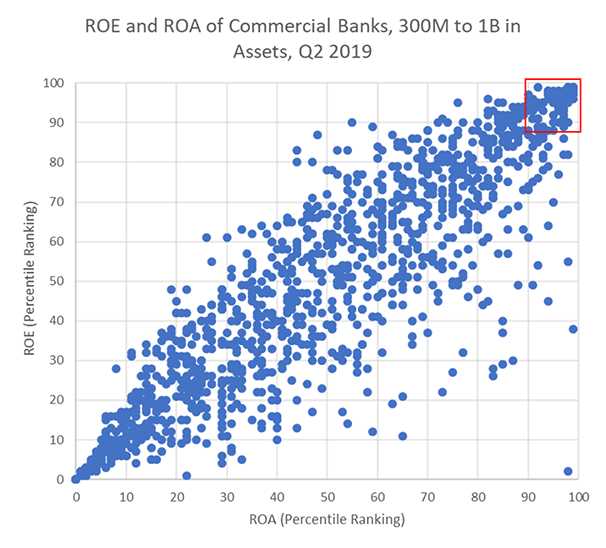

As a service to the industry, we are continually creating new data sets to identify a short list of smaller community banks that consistently outperform their peers. For the purposes of describing our core issuer demographic, we define “community banks” as those commercial banks with assets between $300M and $1B. Within this subset of institutions, we’ve identified those performing within the 90th percentile for both Return on Assets and Return on Equity for three consecutive years.

Here is a selection of 10 of the top 44 banks:

| Bank Name | State |

|---|---|

| HNB NATIONAL BANK | MO |

| THE NORTHWESTERN BANK | WI |

| PRIME ALLIANCE BANK | UT |

| WAUCHULA STATE BANK | AL |

| NEWFIRST NATIONAL BANK | TX |

| FSNB, NATIONAL ASSOCIATION | OK |

| FIRST NATIONAL BANK OF LAS ANIMAS | CO |

| THE CITIZENS STATE BANK | KS |

| BESSEMER TRUST COMPANY | NJ |

| SUTTON BANK | OH |

Drilling Down on the Data: Concentrations of Credit

A closer look at the data for the 44 top performing community banks reveals that 2/3 have concentrations of credit (specializing in certain types of loans) above 30% of their loan portfolio. The lending specialties of these banks are highly diversified, ranging from mortgages, personal loans, credit cards, and commercial real estate. Presumably, community banks which execute well in a targeted lending strategy are substantially more likely to return the sector’s highest returns.

The scatter plot below shows the top 1,000 community banks in Q2 2019. The red block in the upper right represents banks that achieved the 90th percentile for both ROE and ROA. Qaravan compiled a list of 44 banks that have consistently delivered in this quadrant for the last three years.

Why We Produce the Community Bank Top Performers Report

Among the most crucial roles for top community bank leaders is the ongoing analysis of their organization’s performance relative to both time and benchmarks. Keeping a close watch on key performance indicators can highlight opportunities for operational improvement around growth, profitability, and compliance.

Gauging regulatory risk and analyzing key performance data has traditionally been a time-consuming manual effort. Until recently, there have been few options beyond the use of Microsoft Excel spreadsheets and more arduous manual compiling of reporting output from the Federal Financial Institutions Examination Council (FFIEC). By providing a powerful, more intuitive interface to these data sets, Qaravan has largely solved this challenge for analysts, regulators, and executives.

Of note: This is the first Qaravan Top Performers report we’ve published but expect to see these reports on an annual basis.

The following is a link to the complete data set: Q2 2019 Top Performing Community Banks

For more information about Qaravan, please visit www.qaravan.com or contact us at qaravan@otcmarkets.com or 212.220.2185.